Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

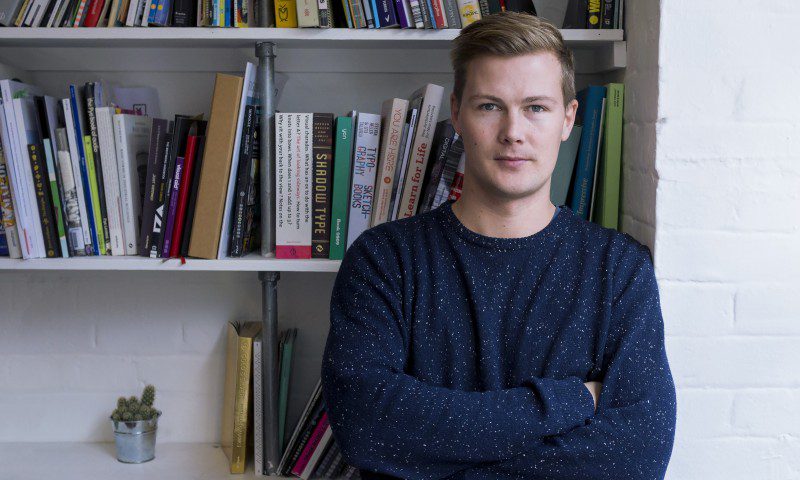

Luxury fashion jewellery brand Carat* spent the latter half of 2014 expanding its footprint both in the UK and overseas. MICHAEL NORTHCOTT caught up with founder and CEO, Scott Thomson

[divider style=”solid” top=”20″ bottom=”20″]

Give us a 60-second roundup of what’s been going on in the last 12 months

We’ve expanded our footprint in Hong Kong and China, and opened about five new locations between those two territories. We have also been expanding our wings a little bit in psecifically Beijing and Shanghai. In the UK we have been trying to consolidate our business somewhat – there hasn’t been too much going on there this year but we have things coming up. We’ve been looking for new locations in central London, which we are soon to give some announcements on, and we have opened a shop-in-shop boutique inside Harrods. We have also expanded our wholesale business by gettng involved with the duty free business; we have opened nine new House of Fraser wholesale doors; we’ve started going on the cruise lines; started working with Shop Direct; opened a store in Ireland. So we have been doing quite a few things here and there.

A lot of expansion for a 12 month period?

Yes, and it continues, it is not going to get any easier any time soon!

What is your personal schedule like?

Well I’m CEO of the business, so I’m managing the teams who loook after each of these areas. We have a nice and efficient structure in place which allows me to bounce between the department heads without too many people reporting to me. I keep it to a maximum of seven people reporting to me, and they manage the other 150 people employed by us.

How have sales performed over the last 12 months?

We just got our management accounts in the other day. There has been different activity in the different territories but overall we had growth of about 18% last year, so we’re not ‘steaming it’ but we’re definitely seeing significant growth going on. A lot of that opening activity happened in the latter half of last year so it doesn’t all show up in the most recent numbers. If we keep growing at around the 20% a year mark then I will be very happy.

What are your aims for the UK market?

Wholesale we are currently sitting at about 150 doors, which I would like to increase to around 300 doors at the very top end. We’re gradually chipping away at that. There’s also our department store doors too – right now we have about 15 of those, and hopefully in the next few months we might do another major deal with a department store chain. We’ll probably have two more of our own shops open in the next 12 months, too.

Do the own-brand stores act as flagships, or loss-leaders?

I’m not at the stage where I can open shops that just lose money. We think the shop we want to open will make money as well. If you want to talk about ‘flagships’, we have a couple of key locations that cement us as a British brand, and they do have an impact on the overall brand halo I suppose.

What sort of turnaround times do you have on new lines?

We’re producing around 300-400 designs a year, more than one a day. They come in groups, bu they’re also dependent upon inspiration too. This year we have produced about 400 new pieces of jewellery. I think for a business our size – we have 250 points of sale around the world now – freshness is important. We hope that when you go to a Carat* boutique, you can go back in a few months time andf there will be something new therew – we’re borrowing a bit from the Zara model in that sense. There is the core product which we continuously produce, the ones that sell well consistently. But we’re also trying to produce freshness all the time – customers need to come and see us three or four times a year instead of just once a year.

What is your career background?

I started Carat* 13 years ago. Before that I used to be a pilot, I studied in the UK, did my private pilots licence, then went to California, did a commercial licence and worked as a pilot for two years. Then I decided I didn’t want to fly planes anymore. I got this idea that I wanted to go into retail, and to cut a long story short, I saw a market in the space between fine jewellery and fashion jewellery and thought that I could create something in this massive gap that would be able to compete with the big guys. Being young and foolish, I was about 28 at the time, I went for it, and that’s the CV. My background in jewellery was only that my sister used to have a jewellery shop in Australia and she gave me some advice on manufacturing, but I took it beyond what she told me because I did not want to produce to the quality she was doing at the time. I wanted to hand-cut our own stones, and put it together the same way fine jewellery is put together. Through a bit of luck I managed to meet some people who believed in me, or maybe they didn’t have any other choice at the time, and we built the business together on this model. They thought I was mad to start with, they wondered how I was ever going to make a profit, but we eventually got there.

Getting started – did you have investors?

No, no investors. It was a small loan from my parents and money I had saved working for my mother for a couple of years in her real etate business. I got started with about £80,000.

What was the first step to getting going?

At that time I wasn’t confident I could do it in London. I was in Hong Kong as this is where I grew up, so I set it up here. It was hugely successful very quickly in that market. From there I then went and opened in Covent Garden and a string of other place. However, throughout that period of time I haven’t always got it right. In 2007 I was about to open in US in New York’s Madison Avenue, I had signed leases in LA, and Las Vegas, and I put almost $1.5m in deposits and so on. The rationale was that about 90% of our e-commerce was coming from the US at that time, but by early 2008 as I was building all these shops it became apparent that it wasn’t going to go well for me. I called all the landlords and told them they could all keep their deposits, because I believed something bad was about to happen. This is about February 2008. I think it would have killed us to support all those locations. So,yes, over the years we haven’t always got it right, but we keep moving forward.

Which markets are performing best in the international picture?

The UK is going to be great – we’re very excited about it. After many years of the doldrums, the UK has the right government, and the right things in place, not being part of the euro has helped. Apparently the UK is going to knock France off as the second biggest economy in Europe pretty soon. As long as we do not get into another housing bubble situation, we’ll be fine. Potentially we think the US is the next big one for us after the UK. Everybody says China is the big one, but it is not paved with gold – it is a long play, there is a lot of competition. There are shopping malls in China that are neomrous – think of the best one in the UK, and they’ve got 1,000 of them in China, packed with the highest possible quality tenants you can imagine – they’re having a Japan-in-the-80s moment there now. I would rather be going into a market that is recovering than one which is peaking.

Growth going forward: what is the five-year plan?

A bit of everything. The biggest contributors we think we’ll be our UK and European wholesale business, and our potential for develpoping in the US. In China, in that five-year period, we will have a substantial presence, but really China is still in the formative stage in the grand scheme of things.