Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

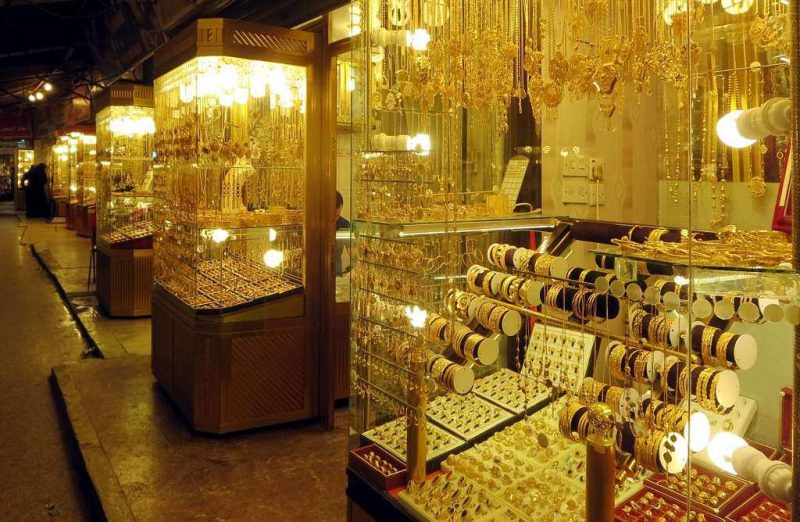

The demand for gold jewellery pieces has grown in Q2 of 2017, despite a decline in global gold demand.

Jewellery demand increased by 8% from 447 tonnes (t) in 2016 to 481t this year, but fell short of the long-term average. India was the main contributor to the gain in Q2.

Total consumer demand also saw a rise, with an increase of 9% to 722t, from 660t in the same period last year.

Global gold demand in Q2 2017 was 953t, a fall of 10% compared with the same period in 2016. This was reflected in a 14% decline in demand for the first half of 2017, which slowed to 2,004t, according to the World Gold Council’s latest Gold Demand Trends report.

Bar and coin investment recovered from last year, with Q2 reporting that demand gained 13% from Q2 2016 to 241t, while H1 demand rose 11% to 532t. India contributed strongly to the recovery. Turkey also saw a strong jump in demand, due to the country’s economic recovery, double-digit inflation and relative currency stability.

Total investment demand in gold fell by 34% to 297t compared with 450t in Q2 2016.

ETF inflows slowed dramatically from last year’s record pace. Nevertheless holdings in the sector continued to grow, adding 56t in Q2, bringing total inflows in H1 to 168t. European ETFs saw the strongest H1 inflows, with holdings in these funds reaching a record 978t.

Central banks continue to buy gold, but at a more modest pace, amounting to 94t, a 20% increase on the previous year. The most recent quarter saw Turkey’s central bank add to its gold reserves – its first significant purchase since the 1980s.

Total supply fell 8% to 1,066t this quarter compared with the same period last year. This was largely led by a sharp drop in recycling, down 18% to 280t, and a continuation of net de-hedging by 5t, in the Q2 price environment. Mine production remained virtually level, falling just 3t to 791t.

Alistair Hewitt, head of market intelligence at the World Gold Council, commented: “Demand for H1 2017 was down 14% compared to last year, but in some respects the market was in better shape. Last year’s growth was solely down to record ETF inflows, while consumer demand slumped. So far this year we have seen steady ETF inflows in Europe and the US, jewellery demand has recovered with good growth in India, while retail investment and technology demand is up too.

“There are a few things to watch out for in the rest of the year. Inflation data out of the US looks soft and markets have pushed out their expectations for a rate rise. The monsoon is looking good in India and, providing the market adapts to the new GST, we may see solid demand around Diwali.”