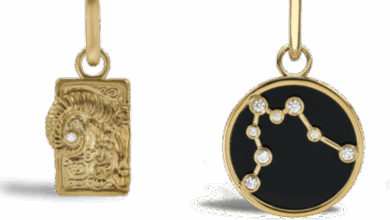

Investors flee Pandora in 15% share price fall

The company misses its 2017 sales forecast by up to £200m

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Pandora’s shares have plummeted by almost 15% in January so far, the largest drop in market capitalisation the company has seen in six years.

The bracelet and charms jewellery brand reported 2017 sales of 22.8bn Danish crowns (DKK) (£2.6bn) were up by 15% in local currencies, but below its own forecast of up to 24bn DKK (£2.8bn), significantly missing its 2017 sales forecast.

The company also announced that CFO Peter Vekslund will be stepping down from his position and is to be succeeded by board member Anders Boyer.

Reuters reported that the forecast for its 2018-2022 margin was down at 35%, from 39.1% in 2016. The company blames a difficult U.S. market, in addition to an 800 million crown foreign exchange loss on revenue.

Anders Colding Friis, Pandora chief executive, said: “The 2017 results are close to the targets we set ourselves at the beginning of the year, but we are of course disappointed to not fully reach the targets.”