Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Has anyone in the government worked out that we are living in the 21st Century? Yes – Why is it then that they continue to base the assessment of “business” rates on a framework and structure that is no longer relevant, appropriate and more importantly equitable in today’s modern Britain?

When a tax was first levied on businesses it was to support the poor, and then turned into the non-domestic rates, a way of taxing businesses locally, based on the nominal “rental income” that could be achieved based on the type, size and location of the property. Furthermore, business rates were an honourable and noble way to tax businesses locally so that they could support the communities where their employees lived, worked and played.

There was a natural logic that the bigger the business, the bigger the office, warehouse or shop would be, and therefore the higher the business rates that could and should to be paid. Everything was in order, and everything was more or less equitable. The businesses based in the towns and cities would use more of the local infrastructure and amenities such as parking for their visitors and customers and so it was logical for them to pay higher rates.

Today, in 2017, does any of this logic still hold true? The turnover and performance of a business may have nothing to do with the number of people employed. With modern communication networks based on broadband, workers can be located all over the world, and wealth can be created through services and virtual products that do not rely on vast offices, shops or warehouses. The shopping experience is evolving at an extreme rate of knots from buying locally, through out of town shopping centres to where we are today with lots of consumers buying online and having their purchases delivered direct to their door.

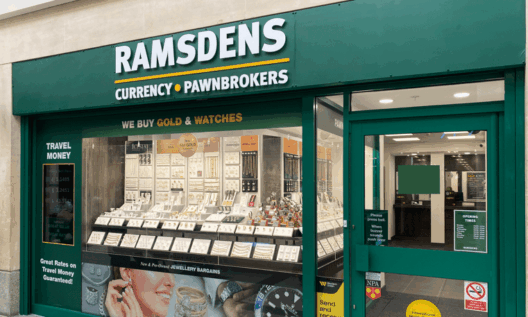

These online businesses are not based where the people using there service live, taking advantage of town centre car parks, filling our high streets with activity and life. They are located in industrial parks who knows where, and they definitely are not paying anywhere near the same level of business rates as the independent or multiple high street jeweller, just as an example. We also see this disparity with many of the high tech multi-nationals like Google, Microsoft or Starbucks when it comes to corporation taxes, but that’s another story.

The current system not only taxes businesses unfairly, it also has a devastating and negative effect on our town shopping streets. Empty shops are being occupied by charities, hardly paying any rates if any at all in a bid to inject life and consumer foot fall back into our towns. Don’t get me wrong, I want to support charitable activity and those who are less well-off than me as much as others do. However, is it right to distort the property market in such a fundamental way? We can see with our own eyes how the high street landscape has been altered over the recent years.

So, my plea to the government is “bite the bullet and devise a system that is fit for purpose for the 21st century”. Just remember, where businesses are based doesn’t mean this is where employees are based, or customers for that matter. Retail doesn’t just happen from shops, but is also conducted online. The use of local services, parking, roads, schools, and hospitals … isn’t just from local people and businesses. From, what I see, the actual money raised is relatively small, so wouldn’t we be better off just adding 1/2p in the £ to corporation tax?

This feature first appeared in the February 2017 issue of Jewellery Focus