Petra Diamonds FY22 revenues jump 44% to $585m

The board has approved a dividend policy targeting an ordinary dividend within the range of 15%-35% of adjusted free cash flows after interest and tax and having adjusted for any windfall earnings

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

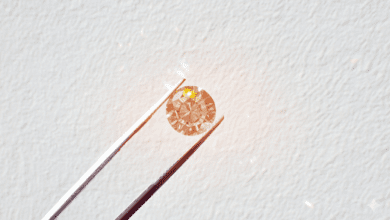

Petra Diamonds has announced its revenues grew 44% year-on-year from $406.9m (£347.5m) to $585m (£499.6m) for the year ended 30 June 2022 (FY22).

This comprises revenues from rough diamond sales of $584.1m (£498.8m) and additional revenues from profit share agreements on partnership stones of $1.1m (£939k).

The increase in revenues from rough diamond sales was driven by a 41.5% increase in year-on-year like-for-like prices, and the contribution from the sale of a “record” number of Exceptional Stones of $89.1m (£76.09m)

Pre-tax profits also surged 875% from a loss of $18.3m (£15.6m) in FY21 to $141.9 (£121.19m) in FY22, and Petra doubled adjusted EBITDA from $130.2m (£111.2m) to $265m (£226.3m) which is up 103%.

Additionally, the board has approved a dividend policy targeting an ordinary dividend within the range of 15%-35% of adjusted free cash flows after interest and tax and having adjusted for any windfall earnings.

Petra also announced its intention to reduce its gross debt through a tender offer to bondholders to purchase $150m (£128.1m) of the Senior Secured Second Lien Notes due in 2026, in line with Petra’s intent to further optimise its capital structure through a reduction of gross debt.

If completed, the transaction will see Petra saving up to $15m (£12.8m) per annum in interest expenses.

Richard Duffy, CEO of Petra, said: “We are delighted with our overall performance, which caps the turnaround begun three years ago. Our continued focus on safety has supported a 48% improvement in our LTIFR. Additionally, sustainability is being integrated across our business through the implementation of our new Sustainability Framework.

“Project 2022, now concluded, has delivered $265m (£226.3m) in net free cash over its three years, contributing to our record financial results for FY22.”

He added: “The diamond market remains broadly supportive as a result of the prevailing structural supply deficit, although ongoing macro-economic uncertainties may lead to some volatility in the short term.”