Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

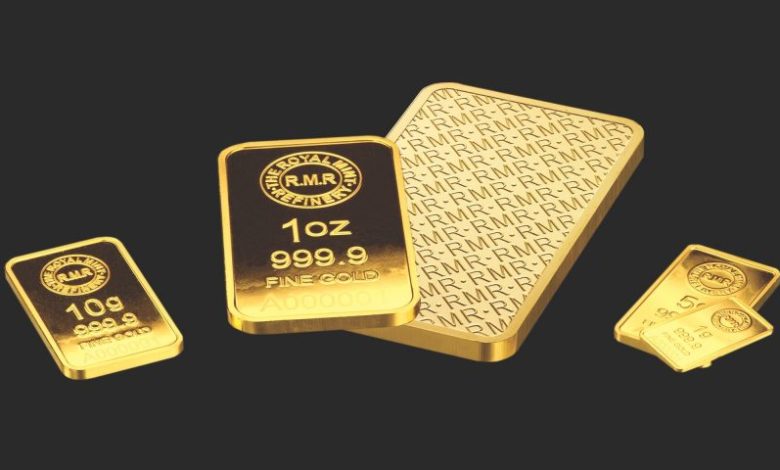

The UK Royal Mint’s gold sales have jumped by 20% in the first three months of the year, according to information obtained by Bloomberg.

The email sent to Bloomberg said that after month-on-month declines in the first two months of 2017, March gold sales had jumped by 263% in volume terms.

Gold sold and stored by the mint jumped 178% in March when compared with the previous year.

According to Metals Focus analyst Junlu Liang, the demand for bars and coins is due to worries of political instability in France and Germany as well as Brexit negotiations. Liang also claimed that negative interest rate policies had an influence.

It is likely this will put increased pressure on jewellers, with increased investment continuing to drive up the price of gold bullion. Gold hallmarking has already fallen in recent months, down 30.5% in February’s figures.

He added: “We’re still seeing safe-haven demand in Europe, with both macro uncertainty and political uncertainty.

“You have negative rates in both real and nominal terms, plus we had Brexit last year and elections fast approaching in France.”