Remember when buying a mobile phone didn’t come with their own brand of white-labelled cover? Leaving the shop with only the phone, no protection – just a bare £800 device and a prayer for its long-term safety. Questioning it feels a little odd now, cover is bundled up so naturally into the buying process that it seems obvious – but it’s a shift that’s happening everywhere across the D2C space.

Unlike traditional insurance that customers seek out separately, embedded insurance lives within the purchase journey itself. In this way it’s insurance that doesn’t feel like insurance.

While it’s true the travel booking sites have been folding trip insurance into everything for years, what has changed is its sophistication and scope. Contemporary embedded insurance now covers virtually any product category imaginable, using real-time data to price risk and bind coverage in milliseconds.

On the consumer side it solves the “protection gap” – the awkward period between wanting insurance and actually getting it. Where traditional insurance requires buyers to research, compare, deliberate, wait – embedded solutions remove points of friction, automating everything from follow-up to document delivery.

By integrating insurance products directly into the purchase journey of other goods and services, this approach leverages digital platforms and partnerships to make insurance more accessible, relevant, and seamless for consumers. Plugging directly into your existing checkout flow, embedded options appear seamlessly alongside high-value items. Click, buy, and you’re covered.

And behind it, the technology is deceptively simple.

APIs connect retailers to insurance providers, allowing instant risk assessment based on product data, customer location, and purchase history. No human underwriters are needed for straight forward policies, so the entire process happens in the background while customers direct focus on what they want to buy.

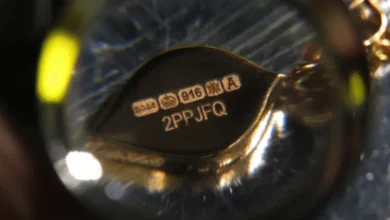

For high-ticket items where customers naturally worry about protection, instant accessibility is fuelling adoption across the luxury goods sector. A £5,000 engagement ring sold with instant insurance helps close a huge psychological barrier to purchase: “what if something happens to it after?”

Experimentally, the numbers support this. Research from McKinsey shows that point-of-sale insurance increases conversion rates by up to 23% in luxury retail, while Deloitte found that 73% of consumers would buy insurance at the point of purchase if offered seamlessly. BCG data suggests the global embedded insurance could reach $722 billion globally by 2030, growing at five times the rate its traditional counterpart.

Retailers boost conversion rates, average order values, LTV (with replacements) – and split policy sale revenue. Insurance providers reach new customers without traditional acquisition costs, and customers get peace of mind without the faff.

It’s a form of retail therapy for a progressively risk-averse buyers, and the same model is easily replicable for brick-and-mortar establishments as it is with native online stores.

Embedded insurance isn’t replacing traditional policies – it’s addressing modern consumer needs for protection that, traditionally, insurance couldn’t efficiently serve. It’s like the difference between booking a full holiday package versus arranging flights, hotels, and transfers separately.

Both work, but one’s simplified and simply more convenient for everyone involved.

💡 Want to explore embedded insurance for your business?

We’re helping luxury goods retailers integrate seamless protection into their sales journeys. Visit assetsure.hostedby.us/embedded-insurance-b2b/ to learn more.