National Insurance Contributions

Coverage explores fiscal and employment policy developments that influence operational costs and workforce planning across the jewellery trade. Stories include updates on taxation reforms, payroll regulation, and legislative changes shaping financial management for retailers, manufacturers, and suppliers. Content highlights how government decisions on business taxation and employee contributions affect profitability, growth, and long-term stability within the UK industry.

-

Aug- 2025 -14 AugustEconomy

UK quarterly GDP beats expectations despite slowdown

UK GDP grew 0.3% in the three months to June, behind the 0.7% it grew in the first quarter, as a result of US tariffs and higher business costs, according to data from the Office for National Statistics (ONS). However, it is better than expected growth as economists polled by…

Read More » -

Jan- 2025 -14 JanuaryNews

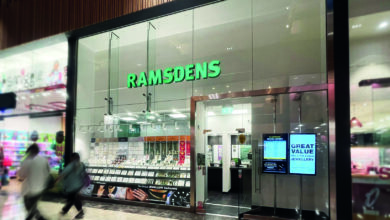

Ramsdens sees profits and revenues surge in FY24

Ramsdens has reported a profit before tax of £11.4m, up 12%, and revenues of £95.6m, up 14%, for the year ended 30 September 2024. The group stated that record profit was driven by growth across all four key income streams. Its gross profit also increased 13% from £45.8m to £51.5m.…

Read More » -

7 JanuaryEconomy

BRC warns of 2025 falling sales volume despite December sales growth

The British Retail Consortium (BRC) has warned of possible falling sales volume in 2025 despite the modest increase in total retail sales experienced in December 2024. UK total retail sales in December 2024 increased by 3.2% year on year, against a growth of 1.9% in December 2023, according to new…

Read More » -

Oct- 2024 -30 OctoberNews

Budget: Increases to employers’ NI and minimum wage

The Chancellor Rachel Reeves has increased Employers’ National Insurance contributions in a bid to help raise as much as £40bn in taxes, pledging to also boost long-term growth and “mark an end to short term-ism” as part of Labour’s first budget since it came into power. Employers’ National Insurance contributions…

Read More » -

Feb- 2022 -18 FebruaryRetailers

Retail sales up 1.9% in January 2022

Retail sales volumes rose by 1.9% in January 2022 following a fall of 4.0% in December 2021, according to the latest figures from the Office for National Statistics. It also revealed sales volumes were 3.6% above their pre-coronavirus (Covid-19) February 2020 levels. Non-food stores sales rose by 3.4% as home…

Read More » -

Sep- 2020 -14 SeptemberCoronavirus

700,000 jobs at risk as end of furlough scheme draws near

Over 700,000 employees are at risk of being made redundant in the second half of 2020, research from Institute for Employment Studies (IES) has revealed. IES estimates that some 650 thousand redundancies are expected in the second half of 2020, with 445 thousand redundancies in the three months between July…

Read More » -

Jun- 2020 -30 JuneCurrent Affairs

Government confirms changes to ‘flexible’ furlough scheme

The UK government has confirmed the latest set of changes to its “flexible” furlough scheme – dubbed CJRS V2 – ahead of its launch of the 1 July. HM Revenue and Customs has set out the new guidance as the current version of the Coronavirus Job retention Scheme (CJRS) ends…

Read More » -

May- 2020 -5 MayCoronavirus

Furlough errors could cost small firms

SMEs are making errors on their applications for the Government’s furlough scheme, meaning they will have to repay thousands of pounds back to HMRC later, accountancy firm UHY Hacker Young has said. The firm explained it has seen many small business applications for the furlough grant that includes the cost…

Read More » -

Mar- 2020 -27 MarchAdvice

What we know about furlough leave and the CJRS

HMRC published details of the Coronavirus Job Retention Scheme (CJRS) on 26.3.20 which are available here: https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme Key points include: Employees that employers can claim CJRS for For the purposes of CJRS, the definition of employee would include workers and agency workers provided they are subject to PAYE i.e. this…

Read More » -

26 MarchCoronavirus

Self-employed to get 80% income grant

Chancellor Rishi Sunak has announced the government will pay self-employed people a taxable grant based on their previous earnings over the last three years, worth up to 80% of earnings, and capped at £2,500 a month. Sunak said it will run for a minimum of three months, with scope for…

Read More »

- 1

- 2