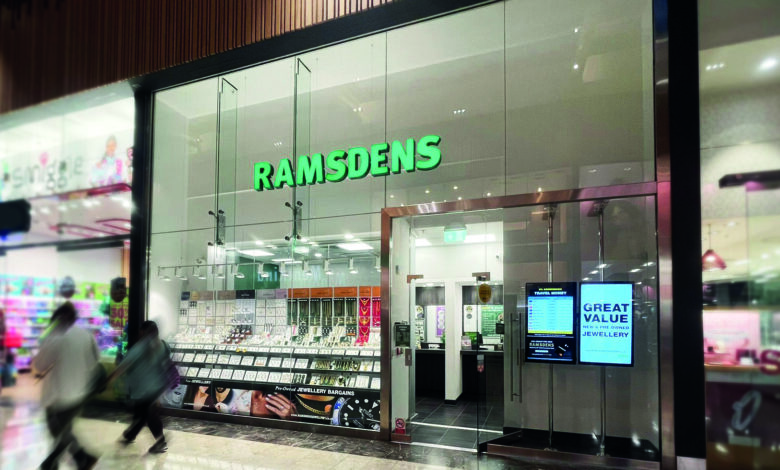

Ramsdens sees profits and revenues surge in FY24

During the period, the group also invested in a new head office to allow greater processing capacity, improve operational efficiencies and provide infrastructure for future growth plans

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Ramsdens has reported a profit before tax of £11.4m, up 12%, and revenues of £95.6m, up 14%, for the year ended 30 September 2024.

The group stated that record profit was driven by growth across all four key income streams. Its gross profit also increased 13% from £45.8m to £51.5m.

Ramsdens recorded that very strong performance was delivered by the purchase of the precious metals segment, with volume and values supported by the high gold price. Gross profit for this segment increased 29% to £11.8m (FY23: £9.2m).

Meanwhile, jewellery retail gross profit increased 10% to £13.3m (FY23: £12.1m) with improved H2 performance providing good momentum into FY25.

Foreign currency gross profit also increased 4% year on year to £14.2m (FY23: £13.6m), and pawnbroking gross profit increased 16% to £11.7m (FY23: £10.0m).

During the period, the group also invested in a new head office to allow greater processing capacity, improve operational efficiencies and provide infrastructure for future growth plans.

Additionally, providing an update on Q1 FY25 trading (1 October to 31 December 2024), the group stated that the purchase of precious metals segment has continued to perform “very strongly”.

The weight of gold purchased has increased year on year by 5% with gross profit increasing approximately 40%. This is due to the continued high gold price (primarily since March 2024) and the timing of additional gold sales in the quarter.

Jewellery retail revenue has also increased more than 15% on the prior year with strong sales of premium watches, continuing the momentum from H2 FY24.

As with many other businesses, the group faces” rising operating costs in 2025”. The main increase is in employment costs as it continues to invest in its people and remains a supporter of paying the Real Living Wage as its entry level pay, which increased 10% in 2024 and will increase 5% from April 2025.

The group also faces an annualised impact of £0.8m from the government’s decision to increase employer National Insurance Contributions.

Following the year end, Ramsdens has opened a new store in Grantham, closed its kiosk site at Teesside Airport, and two of its stores in central Glasgow will shortly merge. Following this, its estate will comprise 168 stores, including one franchised store.

Peter Kenyon, chief executive, said: “Ramsdens’ record performance in FY24 – with profit before tax increasing by 12% to more than £11m – once again reflects the strength of the group’s diversified business model. We are pleased with the positive momentum achieved across each of the group’s income streams, with a particularly strong performance in our precious metals segment where we continued to benefit from the high gold price.

“The increase in sales of foreign currency indicate we are taking market share and – in its first full year of use – our multi-currency card has had a very encouraging start with opportunities for further growth in FY25 and beyond. Jewellery retail has continued to grow and was particularly strong in H2, with our firm focus on stock management ensuring we are generating an optimum return on the capital employed from our investments in recent years. Our pawnbroking loan book continues to grow incrementally and the launch of our new Ramsdens pawnbroking website in November, following the year end, has started well and is already attracting new customers.”